|

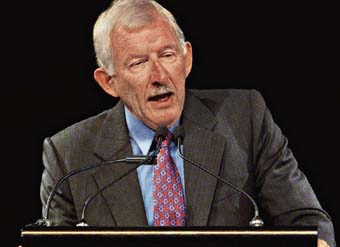

| A growing chorus of economists now believes that the unthinkable is

now entirely possible. Picture: AP |

Deflation: a distant memory becomes

the new reality

By Peter Hartcher By Peter Hartcher

Two years ago, the world's most important central banker would not countenance the

idea.

The chairman of the US Federal Reserve, Alan Greenspan, dismissed the possibility that

the world was moving out of its familar state of perpetual inflation and into a new era of

deflation -- where overall prices actually fall. But now, he's not so sure. Last month he

said: "We must be vigilant to the re-emergence of destabilizing influences -- both

higher inflation, and shortfalls in demand and decreases in some prices that would press

the disinflation process too far, too fast."

The debate has moved a long way. So have the figures. Overall inflation in the rich

countries has fallen from an average of 5.6 per cent in the 1980s to 1.5 per cent last

year.

This year, it's forecast to fall to 1.1 per cent, according to the IMF -- 80 per cent

lower than the average for the 1980s.

And inflation has already fallen through the zero level and into deflation in almost a

quarter of the world economy; in Japan and China, wholesale prices have been negative for

over a year. In Europe, inflation is at its weakest in almost 50 years. In the US, it is

at its lowest since the 1950s.

In Australia, it has sagged below the Reserve Bank's 2 to 3 per cent target zone for

nine straight quarters.

The US investment bank Merril Lynch says in its annual global outlook that

"deflation is a bigger risk than inflation in 1999".

A number of investment firms have started advising clients on how to recast their

portfolios for a new era of stable or falling prices.

A growing chorus of economists believes that the unthinkable is now entirely possible.

"While our policy artillery is still aimed at the spectre of spiralling inflation,

the real danger is spiralling deflation," the Labour Secretary in the first Clinton

Administration, Robert Reich, wrote last month in the Financial Times.

"The generation that witnessed the worldwide depression of the 1930s recalls the

power of this enemy, but memories are distant."

But must deflation necessarily spell catastrophe?

A monetary historian at Melbourne University, Professor Boris Schedvin, explains:

"We have seen two types of deflationary experience over the last 120 years. One

was the big-bang type in the Depression, severe but relatively short-lived. It was over in

seven or eight years.

"The other one was more interesting and gradual and it ran from 1873 until 1896. I

think we are in a period like that.

"Prices fell by about 1 per cent a year over 25 years, but it was not destructive

like the Depression. It was the greatest period of world economic expansion we have seen,

exceeded only by World War II."

Nor was this an isolated episode. There have been at least three other periods of

benign deflation, dating back as far as the ancient Babylonians, according to a history of

prices, The Great Wave by David Fischer of Brandeis University in the US.

In each of these deflationary outbreaks, prices apparently fell but wages held up. It

seems that deflation, like inflation, can be benign.

How do you tell the difference? How can we predict what sort of deflationary experience

we may be entering?

There are three different forms of deflation. One is where prices fall because the

supply of money is shrinking. This is monetary deflation, and it is the nasty member of

the clan.

It was just such a monetary deflation that gripped the industrial world in the Great

Depression when stockmarkets and banks collapsed and the supply of money shrank.

Today, this is unlikely. Governments and central banks have been slapped about the face

by the frightening experiences of economic crisis in Asia, Russia and Latin America.

They have responded by flooding the world with money. Central banks around the world

have made 79 cuts in official interest rates since October 8 last year, according to

Deutsche Bank's chief economist in Tokyo, Dr Ken Courtis.

"This is unprecedented -- virtually one central bank a day has been cutting

rates," he says.

The second form of deflation occurs because there are too many products in the world

marketplace and not enough buyers. Prices fall because of oversupply.

"Competition in the world economy, especially in manufactured goods, has never

been as fierce or widespread as it is today," says the chief economist for Credit

Lyonnais Securities (Asia), Dr Jim Walker.

"This can be traced directly to the collapse of communism in 1989, and perhaps

earlier in China where the reforms introduced by Deng Xiaoping in 1978 were moving the

country steadily away from the centralised planning orthodoxy as early as the mid

1980s."

It is an an obvious but crucial point that China boasts 27 per cent of the world's

supply of labour. Its reintegration into the world market economy is an event of deep

significance.

Altogether, the collapse of communism brought 3 billion people back into the market

economy. Before they can be consumers, they must be producers. And they have been very

productive.

"The result: massive downward pressure on low value-added, labour-intensive goods

prices," says Walker.

"It is good news for low value-added goods consumers, mostly in the rich

countries, and bad news for the low value-added goods producers, mostly in the poor

countries.

"Deflation through competition is not a negative force in the world economy,

merely a redistributive one."

But such hyper-competition is not limited to cheap products made in poor countries. The

car industry, for instance, is a victim, with world production capacity at 60 million new

cars a year and world demand at only 44 million.

This helps explain the rash of mergers and rationalisations in the industry as it

adapts to the new era of super competition. By the end of the process, more factories will

close and some firms will go out of business.

The same will happen in most industries which sell mass-produced manufactures that do

not contain proprietary technology.

Which leads us to the third form of deflation: technological deflation.

During the Industrial Revolution, new technology in the form of the steam engine and

the cotton gin pushed prices down. In turn, economic activity and real incomes rose.

Today, a similar process is under way, driven by the microchip. The price of computing

power itself is falling -- a DRAM memory chip cost $US20 per megabit three years ago but

less than $US2 last year.

But the application of computers is driving a host of other innovations, and these are

pushing down prices in many areas of the developed economies.

Cheap chips cut the cost of manufacturing and communications and searching for oil. The

internet throws open areas of the economy to new competitors, demolishing barriers to

entry, and pushes prices down.

"The internet will hit the services sector quite hard over the next three years;

it will help drive prices down," predicts the global economist for the Zurich Group,

David Hale.

These changes lift productivity and output, and as prices fall, real wages rise.

"This form of deflation is an unbridled positive for the world economy," says

Walker. It parallels the deflation of late last century where prices were falling but the

US economy averaged 6 per cent annual growth.

This is why the chief investment officer of Norwest Investment Management in the US, Mr

Jim Paulsen, says the US is already in a "deflationary boom".

The chief economist for the Hong Kong and Shanghai Banking Corporation, Dr Jan Lee,

argues: "Deflation is real, and I think Greenspan is warming up to saying that it is

happening fundamentally because of technological change.

"And if he's right, there's nothing for the markets to fear -- there is no way you

can arrest technological deflation through monetary means."

How long might a deflationary era last this time? Professor Schedvin says: "This

is the hardest question of all, but the market's pricing of bonds suggests that we will

face price stability for at least five years and possibly as long as 10."

While the deflation of the late 19th century was benign, it was not equally kind to

everyone. Farmers and other commodity producers suffered. But the technological innovators

thrived.

The consulting American economist Gary Shilling writes in a recent book, Deflation,

that "buyers will continue to rush purchases where rapid innovation leads to

significant new products, dramatically lower prices, and technological advances that make

old models obsolete".

Shilling offers advice for companies in a deflationary era. He suggests emphasising new

technologies, pursuing volume of sales, developing proprietary products, exploring niche

businesses, and avoiding excess capacity.

His advice for commodity companies is: "Be the low-cost producer or get out."

And what of personal investors?

"As inflation goes from 1 per cent to zero, it is incredibly bullish for both

stocks and bonds," says Norwest's Paulsen. "But if it goes right through zero,

it destroys the stockmarket."

His advice is to buy bonds. And if you must buy stocks, he says, look for ones with

pricing power.

While inflation favours borrowers over lenders, deflation turns this on its head. The

reason? As time passes in a deflation, the real value of debt increases.

The soothsayers could be wrong, of course. If they are, the country that is most prone

to a rekindling of inflation will be the US.

In the booming US, unemployment has fallen to its lowest peacetime level in 41 years.

At a rate of just 4.3 per cent, it is now lower than Japan's for the first time since the

Vietnam War.

There is no hint of the inflation that such a labour shortage has customarily

triggered. In fact, the broadest measure of inflation shows that it was at just 1 per cent

-- its lowest since the 1950s.

But many US economists believe that the labour shortage will eventually create an

inflationary squeeze.

Deutsche Bank's Ken Courtis, however, believes that even a revival of US inflation in

the short term would not be enough to turn the tide of deflationary pressure in the medium

term.

"Over the next 18 months, there will be reflation" as central banks increase

the money supply in the rich countries, he says.

"I think this could create a cyclical pop in gold prices, maybe oil, and we've

seen accumulation of some of the big cyclical stocks like aluminium and pulp and paper.

"But I don't think there's enough in it, for the simple reason that two of the

world's major three economies are in structural slow growth.

"Japan is stuck with very slow growth and the Europeans are over the moon if they

can get 2 per cent growth in one year of every decade.

"The Latin Americans are having a hell of a time, and in Asia, not one country has

demand exceeding supply. There is just not enough demand."

The balance of risks, as Greenspan would put it, for the global economy seems to have

moved away from inflation and towards deflation. But as a time traveller from ancient

Babylon or the 19th century could testify, that's not the end of the world.

� This material is subject to copyright and

any unauthorised use, copying or mirroring is prohibited. � This material is subject to copyright and

any unauthorised use, copying or mirroring is prohibited.

|